Yesterday came news that the world’s largest custodian bank, Bank of New York Mellon Corp (BNY Mellon), had invested in the cryptocurrency custody company Fireblocks. That investment of USD 133 million, which other funds also participated in, nearly makes Fireblocks a unicorn.

Cryptocurrency custody is a whole sub-industry by itself.

Just like with an individual, when a company/institution buys cryptocurrency, it is responsible for storing it.

When you lose access to your crypto wallet – either because your wallet was hacked or because you lost your access key, there’s no central authority you can turn to, as we saw in a previous post on this channel:

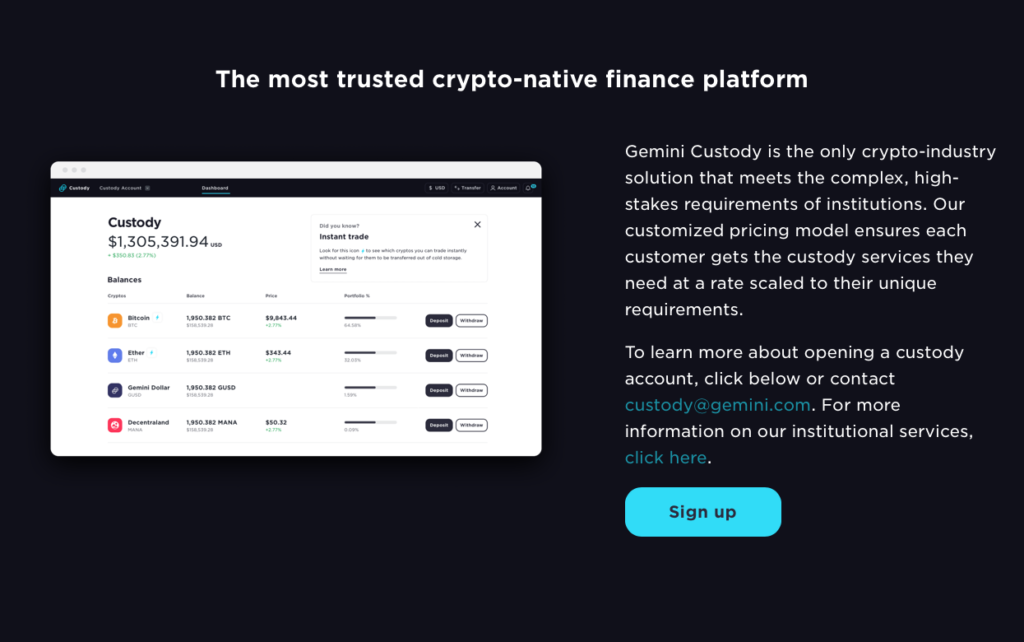

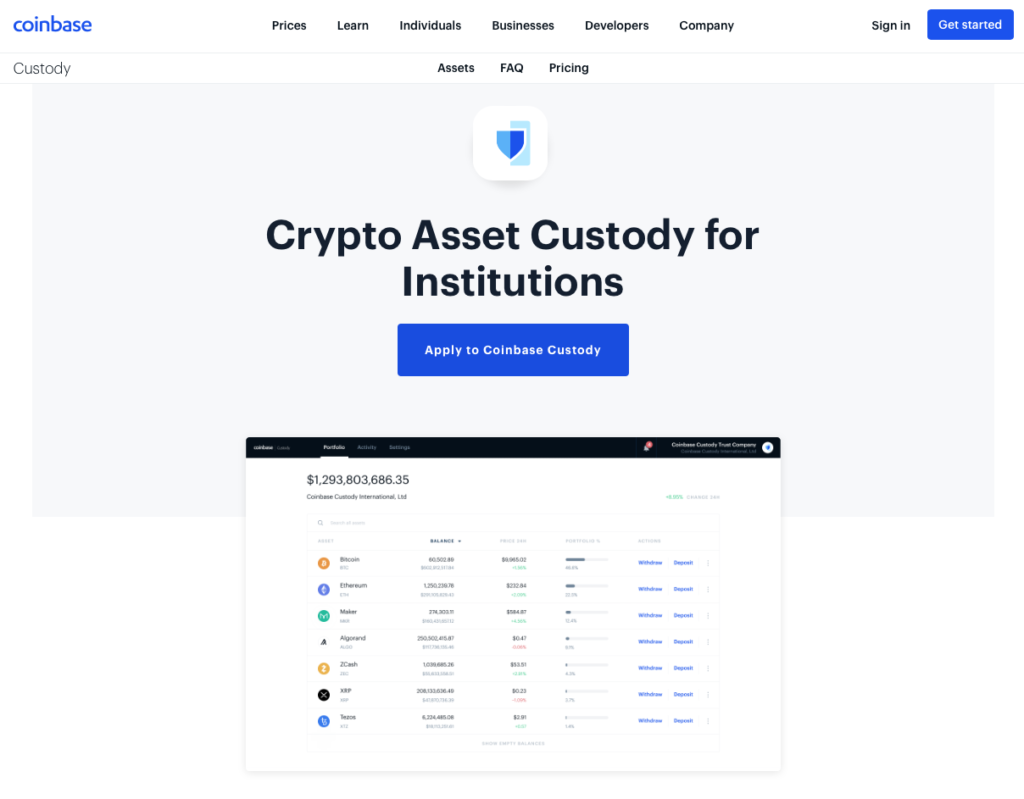

As institutions hold large amounts of cryptocurrency, several players have gotten into the business of safekeeping and third-party access. Fireblocks is one of them. Other crypto players are also in the custody business, such as Coinbase and Gemini, both major exchanges.

Then there are specialist custody players: Anchorage, BitGo, Komainu, and, of course, Fireblocks. PayPal, whose bet on crypto we’ve seen a few times, also got into the space recently via the acquisition of the firm Curv.

Finally, traditional financial industry institutions also offer custody services, though these are few.

- Fidelity Asset Management was a major early entrant. It is now using its custody expertise to extend loans backed by bitcoin collateral.

- BNY Mellon, which we saw earlier on, is another entrant.

- Now Deutsche Bank, among the world’s largest financial institutions, announced plans for “a fully integrated custody platform for institutional clients” in a December report

- And Kingdom Trust, a regulated custodian of traditional assets like commodities, real estate and other alternative investments, also got into digital asset custody in a big way.

(ends)