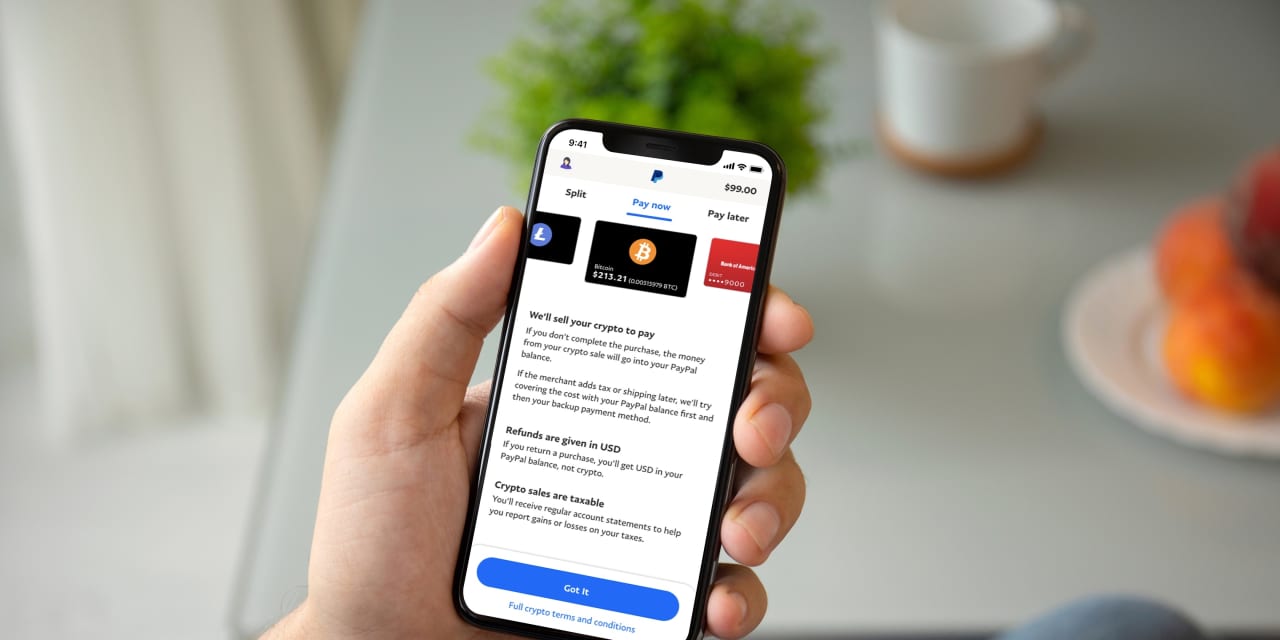

A few months ago, Paypal added the ability for its US customers to buy, hold and sell cryptocurrency in their Paypal mobile wallets. Yesterday, it introduced the ability for people to actually pay for stuff online using those cryptocurrency holdings, when using the Pay with PayPal option:

This is a big deal.

Why? Because overnight, millions of people are now able to buy things with their Bitcoin, Ethereum, Litecoin and Bitcoin Cash holdings.

How did Paypal make this possible? Well, it’s not a direct crypto purchase. The online store (or “merchant”) doesn’t need to accept cryptocurrency. Paypal converts their customers’ crypto holdings into the corresponding fiat currency (US dollars, Euros, and so on) right before the purchase. For the merchant it’s like any other online purchase:

The company plans to settle all of the transactions in U.S. dollars and convert payments to the applicable currencies of its various merchants at its usual conversion rates.

So it’s not really the buyer sending the seller crypto in exchange for goods. But the upside of this indirect method is PayPal opening up millions of customers and millions of merchants to the idea of crypto-based payments.

“We think it is a transitional point where cryptocurrencies move from being predominantly an asset class that you buy, hold and or sell to now becoming a legitimate funding source to make transactions in the real world at millions of merchants,” said Schulman (the PayPal CEO)

Earlier this month, we’d read on this group about Paypal’s plans to set up a new business unit focused solely on cryptocurrency & digital assets. And on its Investors day, the company had said that “it will be investing a lot of money into blockchain and digital currencies.”

Yesterday was a big step forward.