Cryptocurrency has made us all revisit what money really is. Last week I posted about Tether (symbol USDT), a so-called ‘stablecoin’. It’s a crypto token whose value is supposed to be one US dollar because the company behind it claims it is backed by an equal number of US dollar deposits.

Except that it has repeatedly failed to show audited results that those dollars actually exist. Last week, it settled a case with the state of New York. The attorney-general had some pretty harsh words for the company:

“Tether’s claims that its virtual currency was fully backed by US dollars at all times was a lie,” she added… The investigation found that, no later than mid-2017, Tether “had no access to banking, anywhere in the world, and so for periods of time held no reserves to back Tethers in circulation at the rate of one dollar for every Tether, contrary to its representations.”

Despite this ruling, and a fine that the company behind Tether had to pay, trading went on as though nothing had happened. The volumes were down marginally, to USD 93 billion from the high of USD 107 billion.

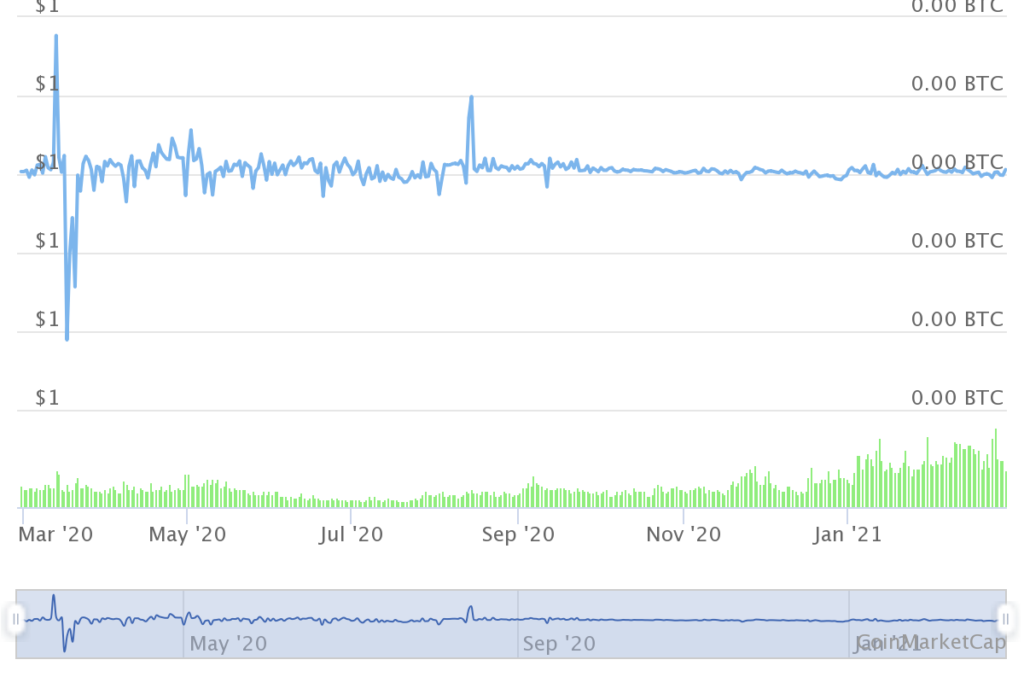

The price is still ~ USD 1, meaning buyers and sellers still trust and treat it as the stablecoin it claims to be but cannot prove. Here are stats from the industry monitor CoinMarketCap. Blue is price, green is trading volume.

Like we had said last week, it’s like Tether is simply a parallel US Federal Reserve (or the RBI) – printing money not backed by anything and (implicitly) pricing it at one dollar to every dollar. Money really is what we all agree money is. That’s all.