Good afternoon, folks. A couple of weeks ago, the Harvard Business Review covered something that became very popular last year: earning interest on your cryptocurrency deposits.

I suggest you add this to your favourite read later service for this weekend:

It used to be that you’d buy your bitcoin and other cryptocurrency on an exchange. Then you’d just hold (hodl!) it in a wallet.

Your tokens would go up or down in value, but you’d never be paid by the wallet service for holding your money with them. Unlike, say your bank, which pays some interest on your savings account or FDs.

That is changing, thanks to financial services that have been built atop plain old wallets.

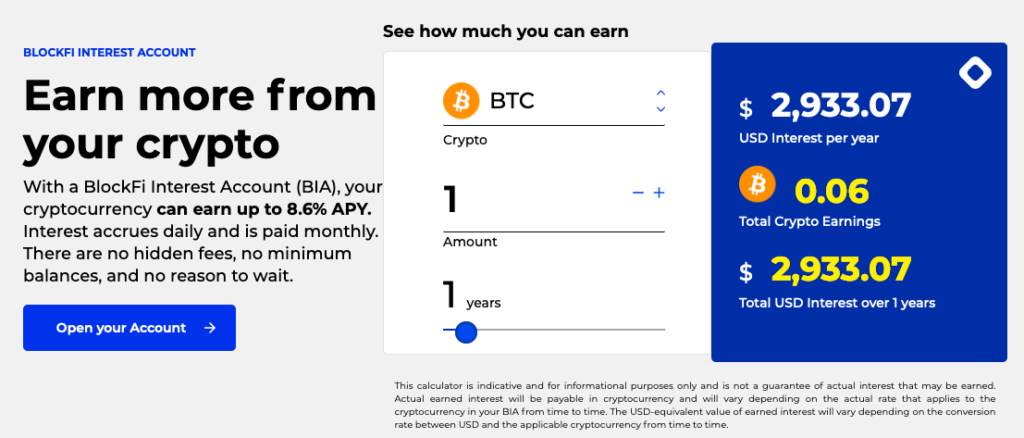

[The crypto exchange Gemini] is launching a new service called “Earn” that lets clients deposit their holdings in bitcoin and other cryptocurrencies into interest-bearing accounts with no minimum balance required. Similarly, BlockFi, a crypto lender backed by tech billionaire Peter Thiel, offers rates of up to 8.6% APY on deposits, while bank savings accounts offer a meager 0.05%.

Exchanges and companies like BlockFi lend out your crypto deposits, to institutions and to automated market makers. From BlockFi’s own FAQs:

What Does BlockFi Do with Account Assets? BlockFi generates interest on assets held in Interest Accounts by lending them to trusted institutional and corporate borrowers. To ensure loan performance, BlockFi typically lends crypto on overcollateralized terms (similar to the structure of our crypto-backed loans).

PS: the section on automated market makers is also super interesting. Maybe we’ll do a post about it in detail, soon.