Today we revisit a Forbes article from late 2018 revisiting the state of some of 2017’s frenzy of initial coin offerings, or ICOs.

ICOs were designed as a way for crypto projects to raise money from the public in return for a share in the equity or in the profits of the company or – most commonly – simply get the project’s token early & profit of the supposed spike in value once the project launched.

And as the article says,

Unlike initial public offerings, or IPOs, they required no lawyers, bankers or regulatory approval and were more akin to Kickstarter-style crowdfunding, except funds were raised in cryptocurrency, typically bitcoin or ethereum.

As you might have guessed, dozens – hundreds, maybe – or projects raised money via ICOs. There were ads online, on hoardings, in magazines. Some ideas were quite wild:

Even in 2018, the majority of projects from less than a year ago were not doing well:

Of the 141 largest ICOs in 2017, 86% are trading below their listing price, and 30% have lost almost all their value, according to EY

But their founders were

Others shrewdly converted their crypto into fiat currency near the peak of the crypto bull market, locking in huge gains. Three of the 10 projects currently hold more in crypto and cash than what they originally raised

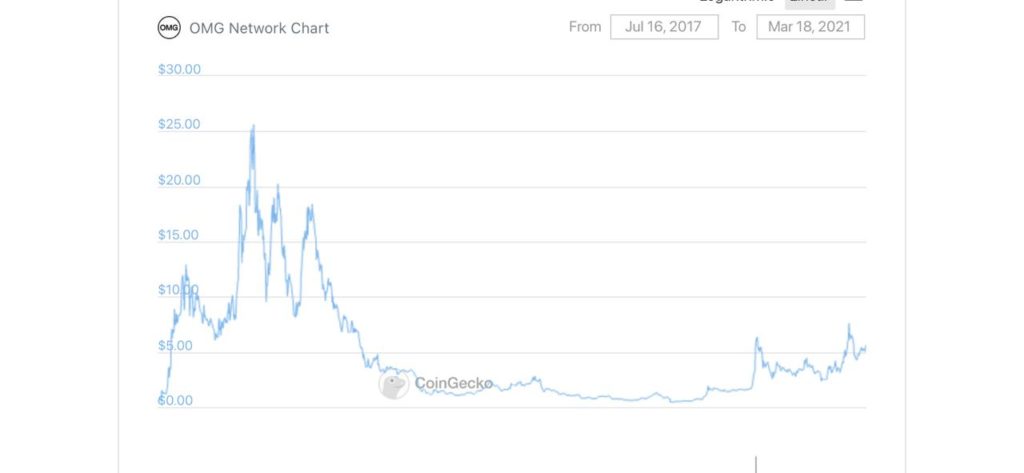

To conclude, I looked at the current price of the token OMG or OmiseGo, one of the first ‘billion dollar ICOs’. Billion dollar = what the total token pool value was, not how much was actually raised. OmiseGo was supposed to provider interoperability between reward programs and private currencies the world over. Now:

The ICO frenzy of 2017 and early 2018 doesn’t get any attention now, especially given the new bull run in the price of crypto, and mainstream interest. But it was wild. We may never know how many billions were raised and – mostly – pocketed.