Last evening, I read about how wealthy investors – and even their advisors – now wanted cryptocurrency to be part of their portfolios, but that investment advisor platforms by and large don’t offer access to it.

A small, but increasing number of advisors like Gerber want to incorporate digital assets into their practices — 9.4% of advisors are allocating part of client portfolios to crypto in 2021, up from 6.3% last year

Problem is, there’s hardly any infrastructure to help financial planners give advice on digital assets, rather than just invest in a crypto product.

– Rising demand, little support: Inside advisors’ crypto headache

The article then goes on to profile two new entrants to the investment advisor (RIA) landscape that are starting to offer crypto access:

24-advisor RIA Gerber Kawasaki Wealth and Investment Management, will be adding Bitcoin to the portfolios of clients who request it through Gemini, the crypto exchange and custodian started by the Winklevoss twins…

Onramp Invest… is building its first product rendition for FAs and recently secured a $500,000 round of funding

When I read this article, Fidelity Investments was the only large platform that offered this:

Fidelity Digital Assets, which launched in 2018, now has approximately 100 clients, according to Terrence Dempsey, head of product at the unit. That includes hedge funds, family offices, RIAs and broker-dealers, he says.

This morning, I woke to news that overnight, Morgan Stanley became the first big bank to offer access to crypto to its investor clients – although indirectly, via Bitcoin funds:

The investment bank, a giant in wealth management with $4 trillion in client assets, told its financial advisors Wednesday in an internal memo that it is launching access to three funds that enable ownership of bitcoin

– Morgan Stanley becomes the first big U.S. bank to offer its wealthy clients access to bitcoin funds

This still comes with limits: ~ It’s only open to those clients who have USD 2 million+ with the firm ~ And crypto is limited to 2.5% of their total net worth

But to conclude, in any case, it’s a big step forward, given that

Goldman Sachs, JPMorgan Chase and Bank of America’s wealth management divisions do not currently allow their advisors to offer direct bitcoin investments.

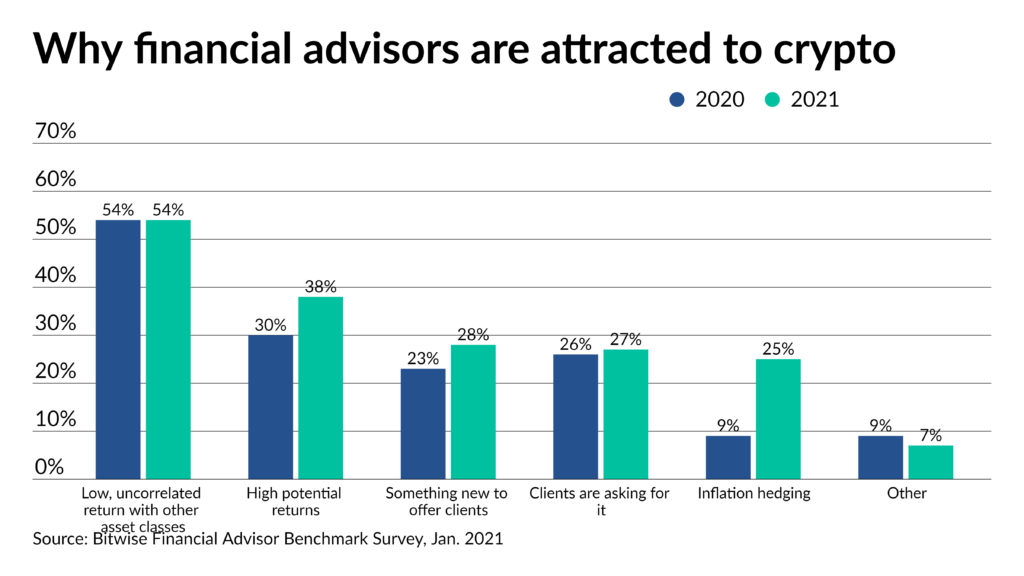

PS: Mainstream ownership of crypto is now going to be inevitable. It’ll be interesting to see how long the appeal of Bitcoin as a hedge against other asset classes is going to remain – this lack of correlation was the primary reason financial advisors had wanted their clients to invest in crypto.