The Economic Times reported recently on how Indian crypto exchanges are scrambling to process payments. As we have seen, banks have suddenly declined to work with them, possibly because of informal pressure from the RBI.

Now, the Mobikwik prepaid wallet has been left as one of the few ways you can get Indian rupees into crypto exchanges in order to buy bitcoin, ethereum and other tokens. But that access comes at a cost.

Even if you can load your prepaid wallet at no cost via UPI (an instant bank-bank transfer method),

- You pay 1.5% + 18% GST on Mobikwik’s own gateway to money from their wallet to the exchange

- plus the local premium on BTC/ETH/others over the global BTC/ETH price

- plus exchange fees on every purchase.

- plus transfer fees to move it to your off-exchange wallet.

And because the source is a prepaid wallet you’re limited by law to ₹100,000 per month, or ~ USD 1350.

(to be clear, I’m not blaming Mobikwik for this at all.)

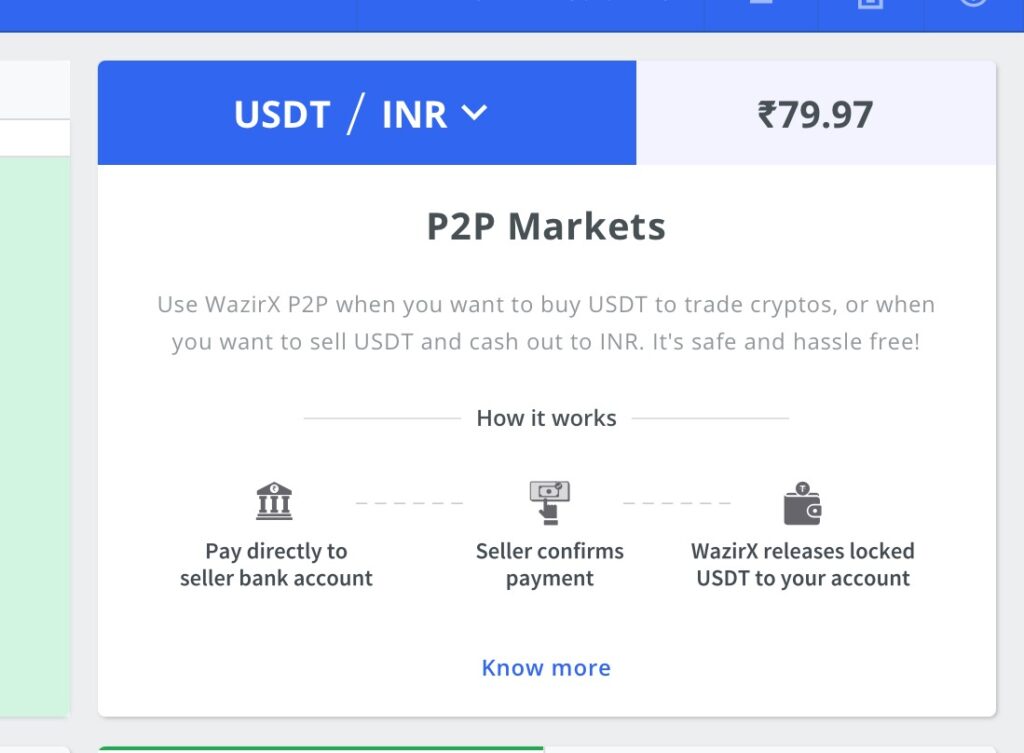

An alternative around this is peer-to-peer, or P2P. You can send money in Indian Rupees (INR) to people who already have crypto, and they’ll send you the equivalent tokens into your wallet. Many exchanges offer this as a trusted mediator, globally:

But there are inefficiencies. For instance, yesterday afternoon,

- The stablecoin ‘Tether’, the crypto equivalent of one US dollar, was available at INR 79-80

- But the INR-USD exchange rate at the same time was INR 72-73 per dollar.

- That means P2P was available at a 9.5 to 11% premium.

See screenshots:

And this was just to get USDT tokens. The exchange will charge its usual fees to sell USDT in return for Bitcoin, Ethereum or other tokens.

P2P crypto exchange is a boon. But ultimately it’s a workaround for unclear regulation. And you and I pay a harsh premium for that workaround.