Two major, long-time hedge fund managers were recently asked in detail about their opinions on bitcoin and cryptocurrency. Today, we look at Ray Dalio of Bridgewater.

Dalio spoke at the Consensus conference, organised by the publication Coindesk.

~ Dalio thinks the US dollar is at risk of being devalued at a level not seen since 1971, when it moved off the gold standard

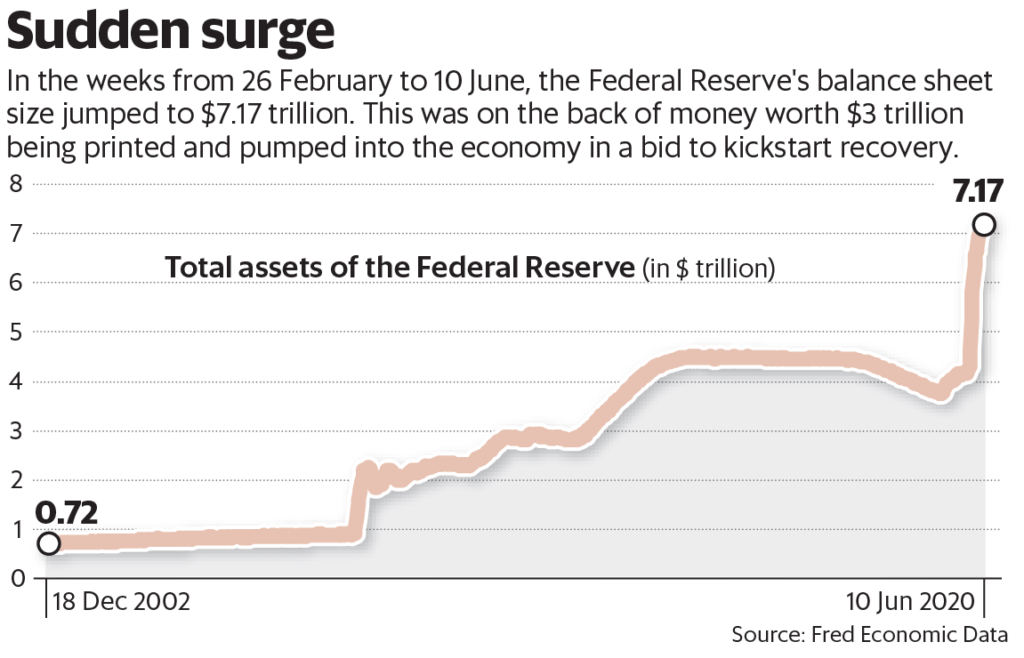

~ This is because of unprecedented amounts of dollar printing (and therefore creation of new debt) by the USA central bank, the Federal Reserve to finance the pandemic stimulus, which itself is larger than the one after the financial crisis:

~ The impact of this is seen, he says, in the recent rise in inflation (ie. how fast the price of goods and services rises because there is more money available). USA inflation in 2020-21 was over twice the USA central bank’s long term target of 2%.

~ Inflation reduces the purchasing power of people. As Dalio says, ‘cash is trash’, so people buy other assets: real estate, stocks, bonds. That drives bond prices up and yields down, leaving investors search for still other alternatives.

~ This has traditionally been gold, but bitcoin and other crypto is now an attractive option. Unlike the dollar there is no central bank like India’s RBI or the USA Federal Reserve to print more bitcoin. It needs to be mined, and new bitcoin will be distributed as mining rewards at a pre-determined rate. And there will only ever be a finite number of bitcoin.

~ After years of skepticism, Dalio says he now holds some bitcoin, and personally sees it as a favourable option to holding bonds. His fund, Bridgewater, wrote a detailed 6000+ word analysis of their thoughts on bitcoin.

~ Finally, as Dalio says in the document, “Bitcoin’s biggest risk is being successful, because if it’s successful, the government will try to kill it and they have a lot of power to succeed.” Specifically, if large investors start to hold bitcoin as a store of value instead of government bonds (especially in a low-yield environment).

In the next post: Stanley Druckenmiller, who managed George Soros’ Quantum Fund for over twelve years.