One of the most popular decentralised finance products is to earn interest and rewards through what is called ‘staking.’

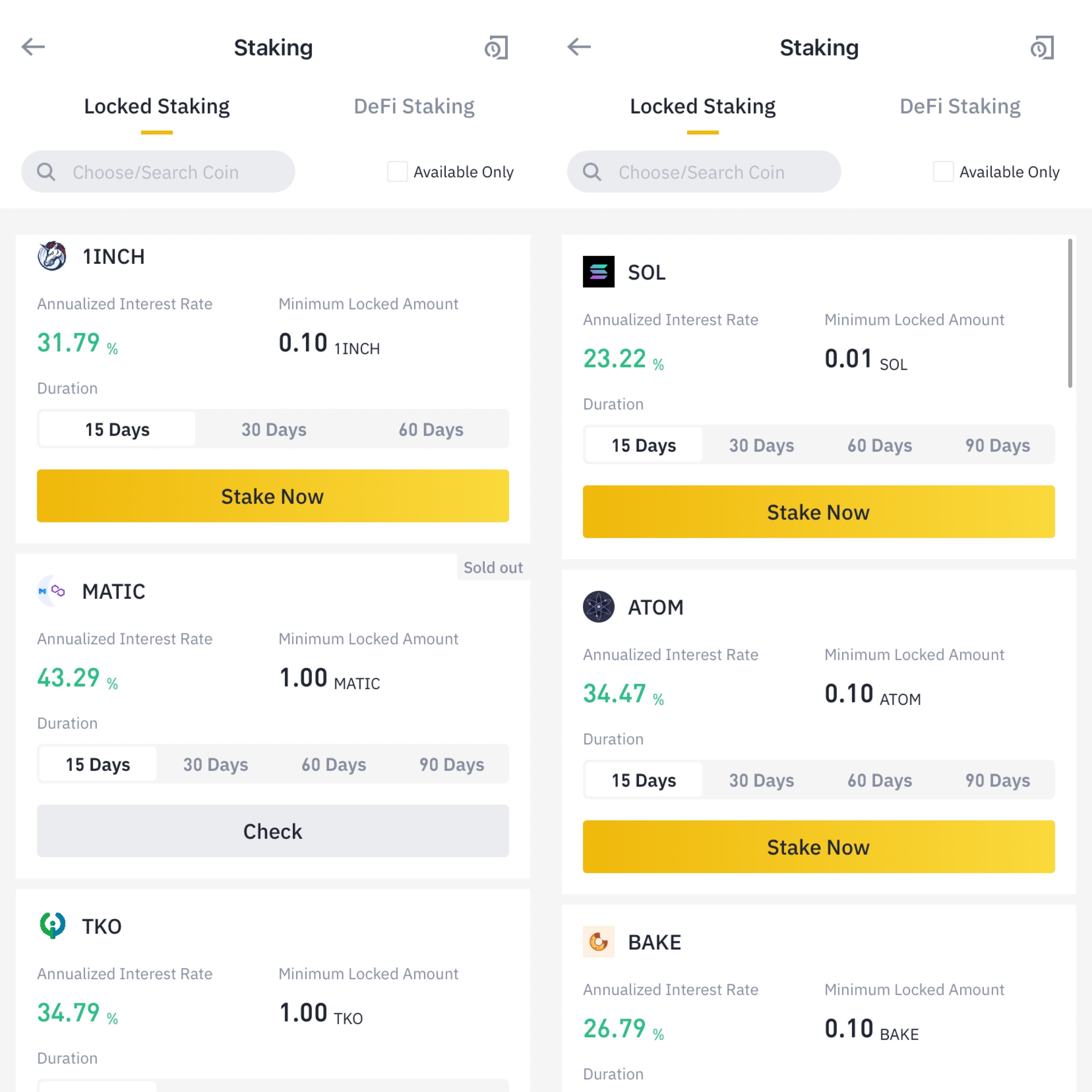

Here are a couple of screenshots of interest rates that the Binance crypto exchange offers on staking a variety of tokens:

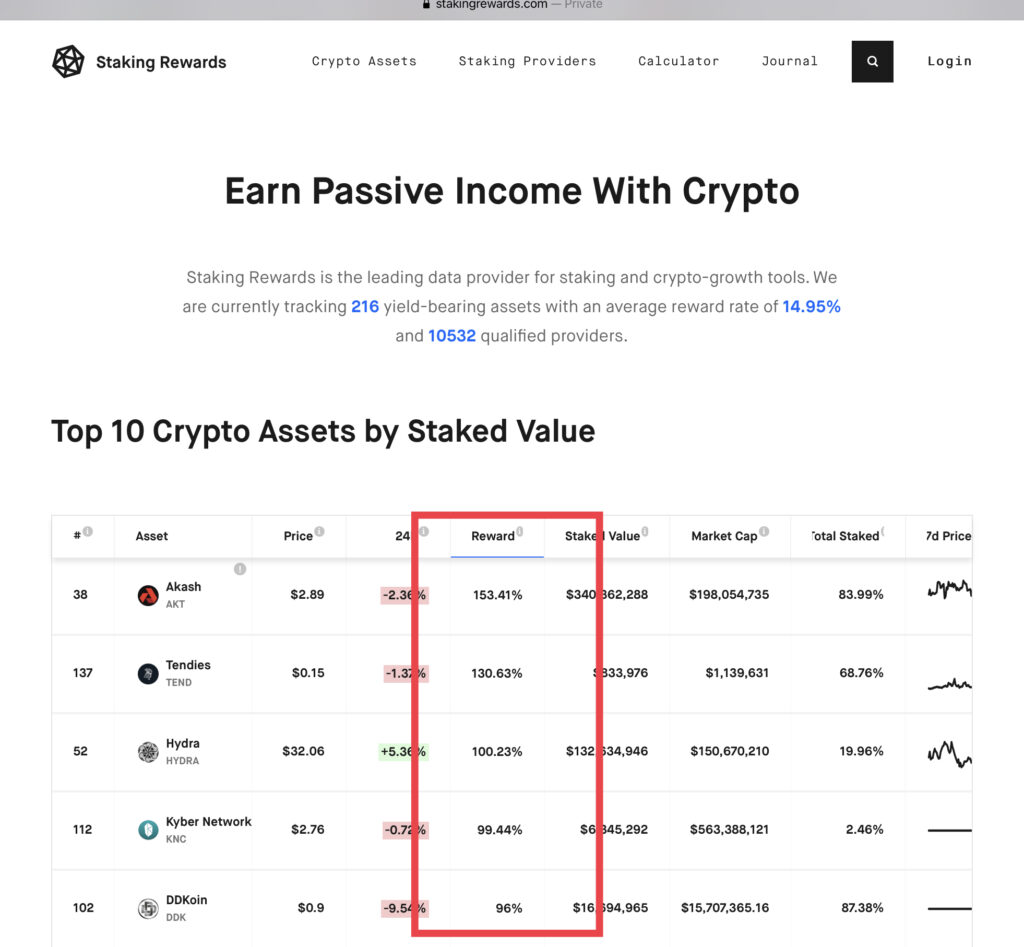

And rewards available on dedicated staking services like the clearly-named StakingRewards:

Given how attractive these interest rates may seem, I think it’s important to understand how staking your crypto holdings works, and what the risks are.

Here’s the crypto company Coinbase describing staking:

Staking is the process of actively participating in transaction validation (similar to mining) on a proof-of-stake (PoS) blockchain. On these blockchains, anyone with a minimum-required balance of a specific cryptocurrency can validate transactions and earn Staking rewards

a node deposits that amount of cryptocurrency into the network as a stake (similar to a security deposit).

The size of a stake is directly proportional to the chances of that node being chosen to forge the next block.

If the node successfully creates a block, the validator receives a reward, similar to how a miner is rewarded in proof-of-work chains.

So, if you hold a set of crypto tokens that are on proof-of-stake blockchain, you can choose to ‘stake’ them and earn interest while also retaining ownership of them. Sort of like fixed deposit meets mutual fund.

Staking pools

Since it’s usually not worth an individual’s time doing this on their own, staking pools have emerged, like the examples we saw above. They aggregate crypto tokens from a large number of people and stake them as one.

As we’ve read, that increases the changes of being chosen as a transaction validation, and therefore of a reward. More such staking pools means more strong nodes, and – to an extent – a more secure network.

Aggregating also means there’s some flexibility in individuals depositing and withdrawing their crypto because there are others to fill in.

But there are risks:

For one, the service you’re using for staking could impose a certain lock-in period (or it could be inherent to the token’s blockchain), you won’t be able to sell your tokens during that period if you want to cash in, or if you want to get out.

Second, you’re effectively handing over ownership of your tokens to a third party to stake on your behalf. You’ll need to do your due diligence about that entity’s reliability: could it usurp my tokens? could it be hacked and my tokens stolen? are the rewards transparent (ie are there hidden fees?)

So. Crypto staking is one way to hold tokens for potential gain in price as well as earn interest on them, often at very attractive rates. Given that it’s all unregulated, beware of the risks and do your homework on who you stake with.

🔗 Join the Whatsapp group for this website to get posts several hours before they show up here.

(As always, none of the entities mentioned in this post are recommendations.)