15 August this year also marked the 50th anniversary of the ending of the ‘gold standard’. The gold standard, or the Bretton Woods system, was a World War II era system of monetary policy among primarily Western countries that required – among other things – that currency be backed by holdings of physical gold, and that the USA dollar be the reserve currency.

In 1971, the USA unilaterally backed out of the agreement, and Bretton Woods in effect collapsed. Currencies were no longer bound to anything, and not bound by anything other than the confidence of the public. 1971 marked the beginning of our era of floating exchange rates. The economic power of the USA ensured that its dollar remained the world’s reserve currency.

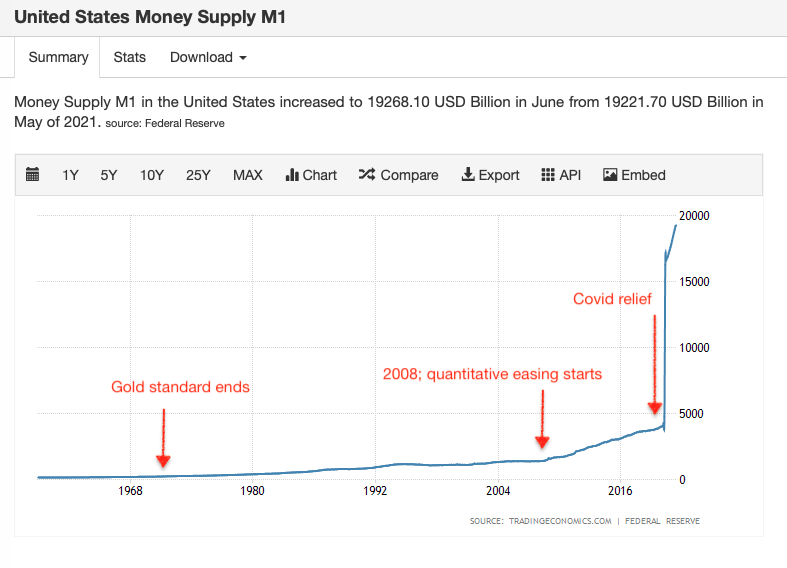

An immediate outcome of the collapse of the gold standard was the freedom for central banks to create ‘new’ money, untethered by the need to have additional gold reserves. Countries across the world have taken since advantage of this. The USA in particular has printed massive amounts of money. First in the wake of the 2008 financial crisis & subsequent years through the Federal Reserve’s practice of ‘quantitative easing’, and then most recently in 2020 to fund Covid relief.

Consequently, this is what the USA’s M1 money supply looked like. M1 is the total of cash and short term deposits in a country’s economy:

The following is extremely simplified but the basic argument remains:

The number of US dollars has fluctuated wildly since the end of the gold standard. And it hasn’t corresponded with a global, or even national, demand for those US dollars – instead it’s been used as a tool to grease the wheels of the USA economy. In other words, it’s been push more than pull. So you’d expect the US dollar to become less valuable as so much more of it is created.

Well, the US dollar is also the world’s reserve currency. One US dollar is one US dollar no matter what. It is other currencies that become more or less attractive compared to the dollar [1]. And because of the outsize influence of the US economy on other economies, that change is usually range-bound.

So that’s where we are today. Currencies aren’t tied to anything. And the US Federal Reserve can create arbitrarily large amounts of money without affecting the value of the US dollar because the US dollar is what everything else is measured in. That provides stability at the cost of completely de-linking demand for the dollar from the supply of the dollar, providing a unique advantage to the USA.

Enter Bitcoin.

Bitcoin has no central authority that can change the rate of issuance. The total Bitcoin supply is capped and its rate of creation is pre-defined, in code.That means no institution or government can intervene to increase or decrease the Bitcoin supply in the market no matter what the moral or economic argument. It’s simply code running on millions of interconnected computers that cannot be practically tampered with.

Therefore, the price of Bitcoin on any day closely corresponds to the actual demand for it. That demand fluctuates greatly, and that is reflected in the volatility of Bitcoin’s price:

What many discussions miss is that the demand for the US dollar also fluctuates, [2] but the US dollar is denominated in US dollars – 1 USD being worth, after all, 1 USD. That gives the impression of the US dollar being somehow infallible and rock solid. But it’s only as solid as the US economy is. That’s fine as long as the US economy thrives, and it’s ok for any individual, country, institution or entity whose interests are tied to the USA’s. But for any such entity, that’s a pretty big economic and political risk.

Bitcoin does not suffer from such risks because it doesn’t depend on any one economy. It is truly native to the internet [3]. It will survive the ups and downs of the US economy. In the future we may reach a consensus to dominate it in terms of some other post-dollar fiat currency, say the Chinese yuan. But Bitcoin’s price will still reflect its demand, and it cannot be artificially propped up or depressed by printing more or less of it [4].

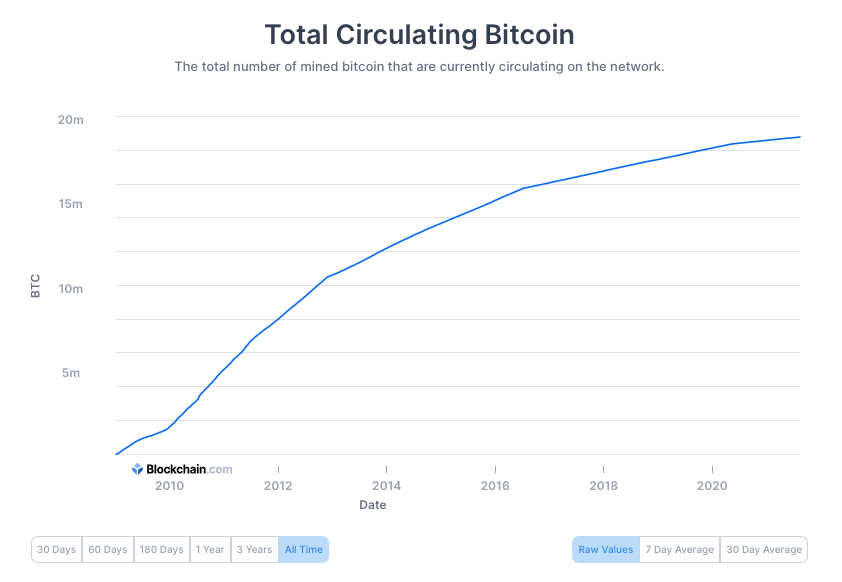

Compare the wild issuance of US dollars in the M1 chart earlier with this chart of total circulating Bitcoin:

The price volatility of Bitcoin is a feature, not a flaw. Put more bluntly, the price stability of the US dollar (and potentially some future reserve currency) is a flaw, not a feature.

And that, readers, is the purest argument for Bitcoin, one that drove its creation as an alternate, internet-native system of money:

Bitcoin is independent of country, geography, economic system, ideology or political party, independent of a mediator, and independent of its denomination in terms of fiat currency, gold or in itself. It is as neutral and decentralised as the Internet is.

[1] That discussion is international. Domestically, as a central bank, if you make a lot of money available, typically more people get easier loans to buy more things, ultimately causing money to become less valuable (because it’s more abundant). That leads to inflation. The USA has, until recently, been able to avoid inflation even during the years of quantitative easing. Critics of QE say that this is because not enough of this newly created money has found its way back to the everyman and everywoman and has remained concentrated in the hands of a few institutions. That’s a whole other topic.

[2] There exists a robust currency speculation market for many different pairs, including of currencies against the US dollar (e.g. the euro <> US dollar). But that doesn’t change the fact that it’s in effect the euro’s price in dollars that’s changing, given that the dollar is the reference.

[3] This is also true of other massively decentralised tokens, including other major cryptocurrencies.

[4] Note that this discussion is about the design of the Bitcoin monetary system versus today’s fiat currency monetary system. There are issues with Bitcoin’s current dynamics: how decentralised it really is, the rising cost of equipment to mine Bitcoin and therefore participate in operation of the monetary system, the costs of actually transferring Bitcoin from one entity to another, how democratic the Bitcoin core committee is, among others. But these are implementation issues, many of which have gotten better over time; they are not fundamental flaws in the design of Bitcoin.