In June this year, El Salvador in Central America became the first country to make cryptocurrency, specifically bitcoin, legal tender. Earlier this week, businesses around the country actually began accepting bitcoin for payments, including salaries.

The background

The current thirty nine year old president of El Salvador has long championed the idea of cryptocurrency as legal tender. He first discussed it publicly as mayor of the capital city of San Salvador.

His take is that it could provide “an accessible financial platform for Salvadorans who don’t have a bank account, about 70 percent of the population.”

He and other proponents have also pointed out that USD six billion, or over twenty percent of the country’s GDP comes from remittance by citizens who live overseas, and that cryptocurrency had the potential to signficantly reduce fees for sending money into the country.

Interestingly, an anonymous donor had kicked off a pilot for the last couple of years in the village of El Zonte, which earned the nickname Bitcoin Beach. The results had been mixed – some people “didn’t have higher-end cellphones needed to download the app, while others said they had doubts about how it worked.”

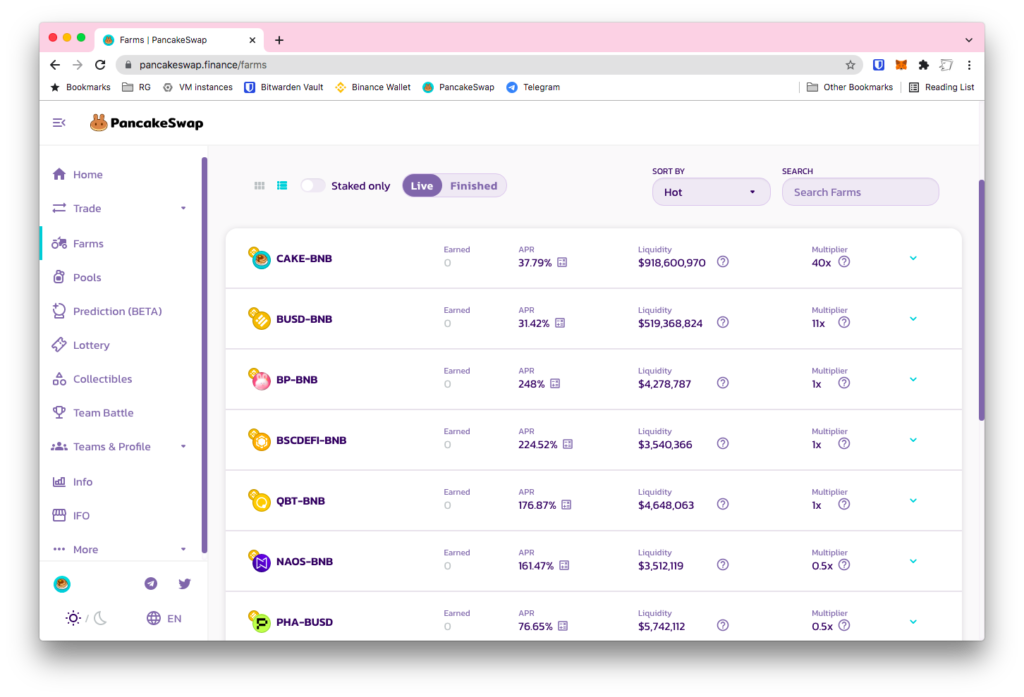

Importantly, bitcoin transactions in the village take place using an app named Strike, which has now also been involved in the national rollout of bitcoin acceptance. Strike, developed by the US based company Zap, processes transfers over the Lightning network that runs on top of the Bitcoin blockchain, as opposed to making actual on-blockchain Bitcoin transfers.

As the Bitcoin Beach website describes it,

New Option using Bitcoin – son uses the new Strike App (https://strike.zaphq.io/) linked to his US bank account to send $100 in BTC over Lightning network. Cost to son $0 and 3 minutes of his time. Cost to mom $0 and receives payment immediately, directly to her phone.

She can buy milk from the local store that accepts Bitcoin (even sending payment directly from her phone sitting in her house and having someone deliver.) She can also pay her electric bill without leaving home, or walk down the street and eat at the local restaurant.

The $7 fee and $2 bus fare mean the transaction costs using Western Union would be 9%, and more importantly a big waste of time and effort. Bitcoin over the Lightning Network fixes this.

The Lightning network

Strike and Chivo, the ‘official’ Bitcoin wallet app at the national level, are both Lightning network apps. Lightning is a ‘Level Two’ technology, which means it works on ‘top of’ the bitcoin blockchain, not on it. It makes a simple tradeoff: it increases speed of transfer for greatly reduced fees. It does this at the expense of decentralisation.

The Lightning network has its own nodes, separate from bitcoin, but connected to it. Two parties on the Lightning network create a private ledger between themselves, called a channel. They can send several transactions back and forth rapidly and cheaply between themselves, no Bitcoin blockchain involved. When they close the channel, the net result is written to the Bitcoin blockchain, with its associated speed and fees and finality.

For several million transactions daily between several million citizens, as you’d expect even in a small country like El Salvador, the Bitcoin blockchain isn’t going to cut it. The Bitcoin network today processes about seven or eight transactions per second at its maximum throughput. Layers like Lightning are a practical necessity for everyday payments. Bonus, they also make micropayments of fractions of a cent possible.

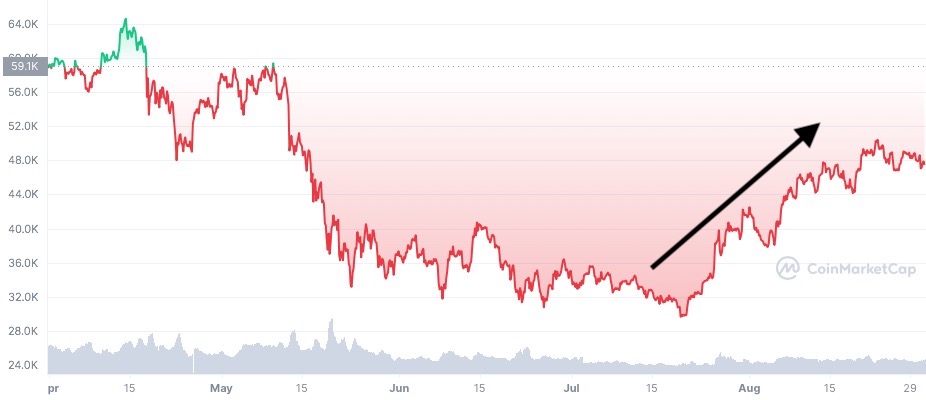

The launch

It went… as well as you’d expect the launch of an entirely new system of payment to go. There were problems with the availability of the Chivo app, problems connecting to the Lightning network, protests about the forced adoption of an entirely online currency in a country without 100% digital penetration, and a huge single-day crash in the price of bitcoin itself (which, to its credit, the El Salvadorian government used to its advantage to make bitcoin purchases of several million dollars).

People also protested the overhead of having every store, every vendor, every roadside operator being forced to accept bitcoin (it being legal currency now!). And not everyone is happy with the president’s declaration in June that “people investing three Bitcoins in country’s economy will be given citizenship by the government.”

But. Despite all of this. Bitcoin is now, alongside the US Dollar, the official currency of El Salvador.

In conclusion

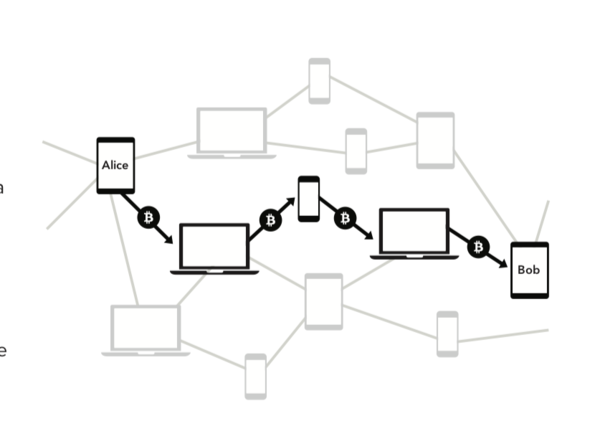

This is a big deal – as a few people have pointed out, a nation-state has adopted as its currency a twelve year old technology that runs only on computers, mostly outside of its borders, owned by everyone and no one.

The promise of low remittance fees is very real. So far it’s been impractical not because of technology but because in most country there are no easy or legal ways to convert received cryptocurrency into fiat currency. That’s no longer the case in El Salvador.

And finally, it’s also true that the vast majority of the El Salvadorian population has been failed by its banks and financial system.

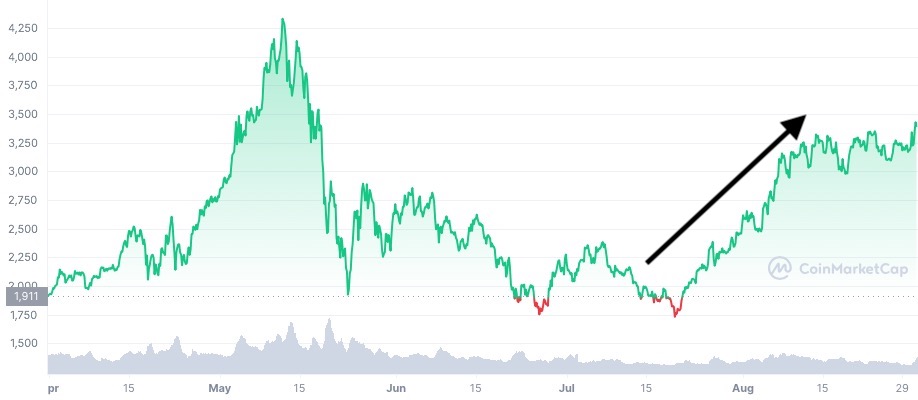

As we’ve seen many times on this newsletter, decentralised finance is remaking large parts of the traditional finance space: storing money, payments, lending and borrowing of all sorts, investments, insurance, and many others, offering conveniences that are not even possible without decentralisation.

There’s no expectation that this move will magically solve the country’s financial inclusion problems, but it does open the door to Defi entrepreneurs to bring their services to the ordinary El Salvadorian.