One of the more interesting applications of NFTs is in games.

The well known game Cryptokitties from 2017 is one of the earliest examples – you can breed unique ‘cats’ that inherit combinations of twelve specific traits that made some combinations rare, and those kitty NFTs valuable.

(Fun fact: The transfer and breeding of the kitties ended up creating bandwidth issues on the Ethereum blockchain, crowding out other transactions and sending ‘gas’ or transfer fees through the roof, giving rise to a whole new set of projects to scale the Ethereum blockchain, probably the most famous of which is Polygon)

In-game NFTs have exploded since, with developers representing all kinds of things on the blockchain and players creating, buying, trading – and playing with them. Axie Infinity took a Cryptokitties-like game concept to another level, with ‘battles’ between Axies, or NFT characters, in return for rewards. Axie got public attention in a 2021 documentary describing how some people in the Philippines who lost their jobs in the pandemic took to playing Axie Infinity to earn tokens & exchange them for ‘real’ money.

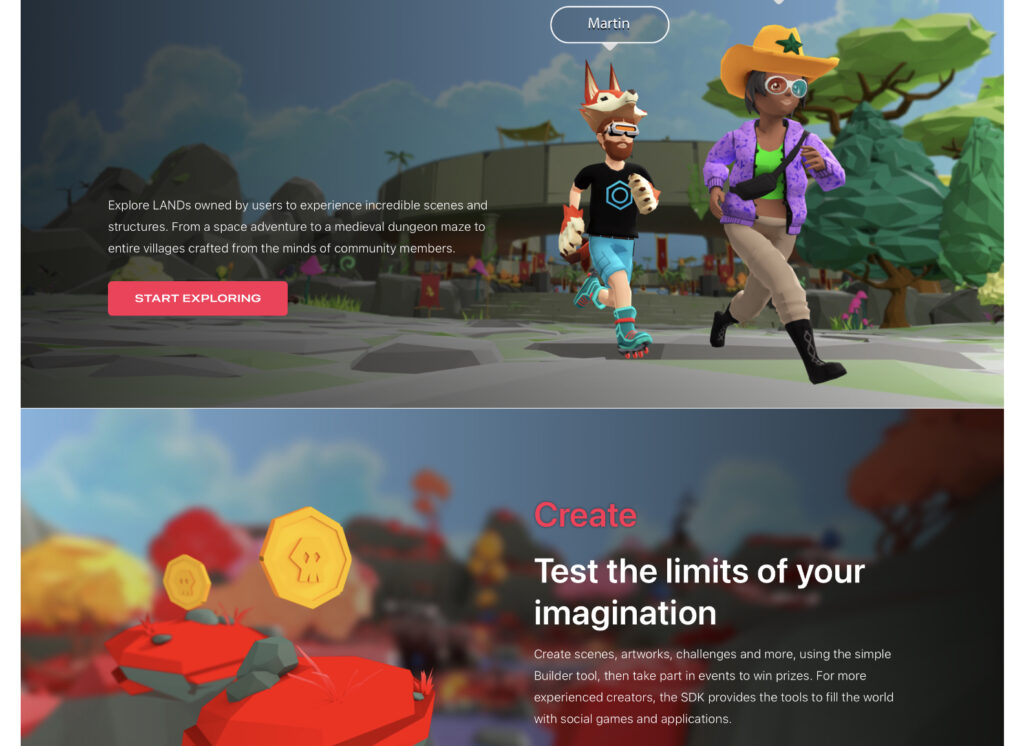

Decentralised gaming is dizzyingly broad and varied, and impossible to do justice to in a single post. But here are some of the more well known ones: Decentraland is a trading-oriented game around unique parcels of land in a virtual universe, Upland does the same thing but maps real-world locations into its virtual world. Sandbox is a similar game where one can generate a seemingly infinite universe composed of NFT land parcels and features by using resources like sand, water, soil, lightning and others. My Neighbour Alice does the same thing but for neighbourhoods and adds a strong social element. Star Atlas takes the same dynamics to space exploration. Mist and Ember Sword are action/combat-oriented role playing games with in-game collectibles that you can win, earn, and trade on NFTmarketplaces like Opensea. There are even more games that have NFTs as core elements in the gambling, racing, puzzle, business simulation and several other genres.

That has given rise to platforms and marketplaces. We just linked to OpenSea, which is a general-purpose NFT marketplace for assets on Ethereum, which also hosts gaming NFTs. Entities like Yield Guild Games buy, sell and rent out Axies, and now all sorts of other in-game NFT assets like virtual land. YGG is an example of decentralised finance intersecting with decentralised gaming. Enjin is a project whose software (or SDK) game developers can user to create, provision, issue, store, trade and destroy in-game virtual goods, whether they’re currencies or NFTs. Xaya is another similar project. Mobox helps create DeFi products with game elements, such as liquidity pools and yield farming, opening up revenue opportunities for game token holders.

There’s the matter of how the object renders across different games, how its utility translates between different games, its constraints, the fact that they be on different chains and use different standards even on the same chain, and so on. To that end, Cryptomotors is a “professional car design studio… creating decentralized digital vehicles powered by the Ethereum blockchain.” And, as an owner of one of these tokens, you’ll be “able to use your crypto vehicles in different 2D, 3D, and VR games and platforms”.

One of the central elements of issuing virtual goods – a concept which is decades old – as blockchain assets is to enable, in principle, users to truly own those goods. For example, a player who owns an element that’s an Ethereum-standards-compliant NFT can store it in a wallet whose private keys only they own. They can sell it on marketplaces like Opensea, rent it like Yield Guild Games does. And, as an increasing number of games are enabling, use the same element across multiple games (subject to questions about IP).

The big difference here is that none of the wallets, marketplaces, rental services or others are built by the game developer. They exist independently of the game developer, and aren’t even limited to games. A single wallet could hold Ethereum currency itself, NFT art, membership token NFTs, vaccination cards issued as NFTs, and in-game elements. That creates a true ecosystem around in-game elements, which – in principle – live on a blockchain forever and – given the right design – can well outlive the original game developer.

Some games have taken community engagement further by handing over part of direction setting and decision making to holders of their community, or governance, token – turning themselves into a decentralised autonomous organisation or DAO. Decentraland, for instance, states that “you, the users… are in control of the policies created to determine how the world behaves… upgrading LAND and Estates to add more features and protocol upgrades, specifics and dates of future LAND auctions… addition of new wearables to the Decentraland World, Builder and Marketplace, replacing members of the Security Council”.

This is a whole new way of thinking about and designing games and building community.

Correspondingly, the interest in the native tokens of several of these projects has caused their dollar prices to skyrocket: Axie’s token AXS is up over 17000% since the beginning of 2021, Sandbox’s native token SAND nearly 14000%, Decentraland’s nearly 4000%, Enijn’s nearly 1700%.

However. Among the more well established game studios, it’s not clear how well they get the idea of tokenised in-game elements. Ubisoft, the company behind games like Assassin’s Creed, Far Cry and the Tom Clancy’s… series, announced its foray into in-game NFTs earlier this month, with items like guns, helmet and face masks for one of its combat games.

It wasn’t well received because the design of its ‘Quartz’ programme seem to negate the whole point of decentralisation. The tech publication Ars Technica is quite blunt, starting with the title of its coverage: “Ubisoft’s first NFT plans make no sense”.

For a supposedly decentralized and “open” technology, Ubisoft places a lot of restrictions on who can own and use Digits. Quartz users have to be 18 years old, reside in one of a handful of countries… and use two-factor authentication on their Ubisoft Connect accounts.

Quartz owners also have to reach “XP Level 5” in Ghost Recon Breakpoint before they can collect or use the NFTs… That XP level status is confirmed by linking Quartz to your Ubisoft account, which is, of course, centrally controlled and subject to its own terms of use above and beyond the detailed Quartz terms of use.

Players who don’t meet any of Ubisoft’s requirements “will not be able to acquire Digits whether on the Ubisoft Quartz platform or an authorized third-party marketplace, nor have another player transfer their Digits to you…

Digits are what Ubisoft calls its in game items. And finally, speaking of these Digits themselves,

A single player, for instance, can only have one copy of each distinct Digit edition… “Owning” that NFT doesn’t give you the right to create derivative works, to use the item in videos, to sell merchandise that includes the item in it, or even to sell “fractionalized interests” in the associated NFT…

But at the same time

Ubisoft says it doesn’t have the ability “to reverse or cancel transactions.” So if you get scammed out of your item somehow, the company can’t help you.

If players don’t own them, can’t port them, can’t sell them except in some cases, and can’t use them in any context other than as defined by Ubisoft, why are they even NFTs? The long-running game-focused website Kotaku picked some comments from those on Ubisoft’s YouTube announcement video, one of which was

Ubisoft, once again, giving us something we didn’t ask for, don’t want and won’t enjoy.

Reactions from other game developers have been varied. The game developer Valve, maker of Counter Strike, Half Life, Team Fortress and others, has already stated that it wasn’t going to allow any NFT items or crypto related content on Steam, its game platform and store. EPIC games, Atari and SEGA have all indicated different levels of interest in the space.

Finally, in some cases developers have also had to contend with resistance from their player community. Like Ubisoft, another game developer announced plans for an in-game NFT element in the game Stalker 2: Heart of Chernobyl. Specifically, it would “auction off the chance for one player to have their face photogrammetrically scanned onto a non-player character (NPC), in what the studio calls the “the first-ever metahuman.””. It’s unclear to me how that would translate to an NFT, or whether the studio even understood the idea or ethos of decentralised elements in a game, but in any case, the outcry on social media from their user base was loud enough that it cancelled those plans.

In conclusion we’re just seeing the bare beginnings of interoperable, user-owned, programmable in-game elements represented as NFTs. We’re only seeing the beginning of how they interact with the other trends in the evolution of the decentralised ledger space, including DeFi and DAOs, and with other tech innovations like Facebook’s virtual reality based pivot to what it’s calling the Metaverse. Even as someone who isn’t an avid gamer, I’m rather curious about innovation that’s to come in this space and how it influences and is influenced by innovation in other areas of the decentralised universe.