This Twitter thread, lucidly written, is an important read for anyone who wants to better understand the wild swings in the price of bitcoin.

It’s linked to the supposed stablecoin Tether or USDT, which is supposed to be the crypto equivalent of a USA dollar.

Tether itself is by far the most traded cryptocurrency. And, a large part (80%) of bitcoin’s trades are people buying it with Tether, or (naturally) selling it for Tether.

Therefore, since 1 Tether is supposed to be 1 USD, you could say the price of bitcoin is really denominated in Tethers, more than in USD.

But there have been serious doubts about whether Tether itself is worth that 1 USD. Strictly speaking each Tether is supposed to be ‘backed’ by cash reserved of one USD.

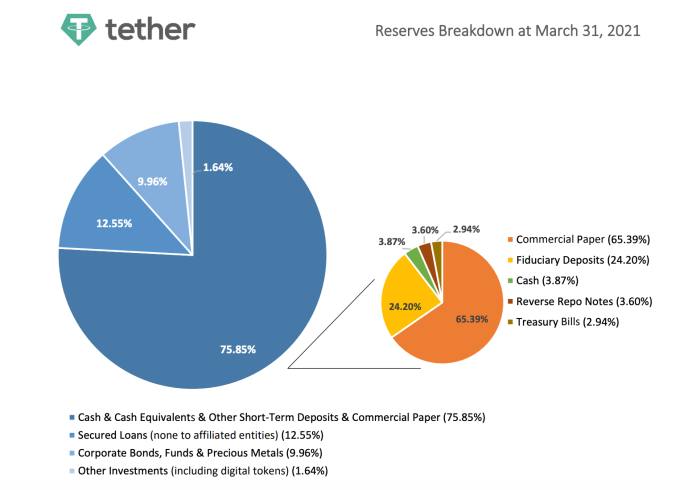

That has been under a cloud for years. Tether has refused to release proper audits of its cash reserves. It has been fined by the New York Attorney General’s office, and now, finally, it turns out a mere 3-4% of its reserves are actual USA dollars.

Here is a graphical view, from the Financial Times:

Finally, as the Twitter thread says,

A significant portion of bitcoin price formation is therefore quoted in dollars, but paid for in USDT dollars that are only actually backed by three cents.

Which would make most of the price formation of bitcoin completely synthetic.

Despite the unquestionable merits of bitcoin as decentralised money, I agree with the writer when he calls the price spike of bitcoin a Madoff-like Ponzi scheme.