Iran is one of the world’s largest oil producers and exporters. For decades, though, it has been economically isolated as a result of USA sanctions.

That makes international trade hard because few countries will accept Iran’s own currency – the rial – and Iran has problems accessing foreign currency. Oil exporting countries usually have no problems with forex – they can choose to get paid in dollars or euros. But Iran has diminishing leverage. Large importers like India and China now pay for Iran’s oil imports in rupees and yuan.

However, this has happened recently:

The Central Bank of Iran has declared that licensed banks and moneychangers in the country can use cryptocurrency that has been mined by officially sanctioned miners to pay for imports, according to a report from the Financial Tribune.

So Iran can’t manufacture dollars or euro, but it can manufacture bitcoin and other crypto. As long as exporters from other countries accept it, this is a sustainable way for it to participate in global trade.

In other words,

Iran is creating forex (a scarce resource) out of energy (an abundant one).

I find this fascinating, but I’m surprised it took so long. And I wonder how long before the USA moves to plug this gap too.

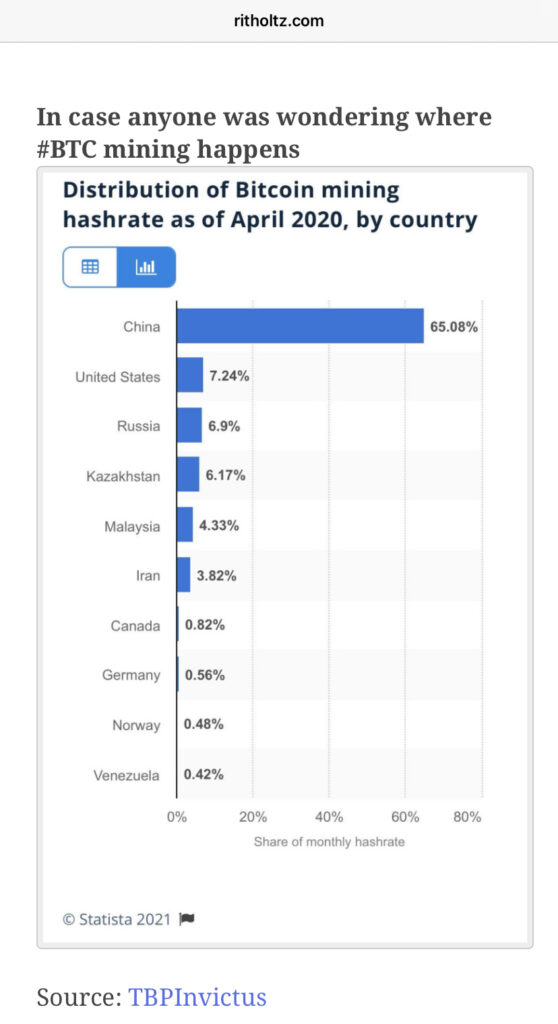

Until then, Iran has become one of the largest countries mining bitcoin:

So much so that private mining is overwhelming the country’s electricity system:

Iran banned the mining of cryptocurrencies like Bitcoin after a series of blackouts across major cities… The government has been cracking down on the 85% of mining that is unlicensed, even enlisting spies to locate miners who hide computers everywhere from homes to mosques.

Bitcoin and cryptocurrency has always been pitched as a means to individual economic freedom. We’re seeing this happen with a whole nation state. Unfortunately, it may be that, through licensing, individual freedom may be curbed for the ‘greater good’ of the country’s freedom.