There’s a provision relating to cryptocurrency in the multi-trillion dollar US Infrastructure bill that’s making its way through the USA Congress.

It’s rather important because it dramatically expands the definition of who is a ‘broker’ and therefore who bears responsibility for performing customer KYC as per the country’s IRS requirements.

Specifically, in the bill, a broker is now also

“any person who (for consideration) is responsible for and regularly provides any service effectuating transfers of digital assets.”

This Twitter thread does an excellent job discussing the implications of this move, including how it’s impossible for some entities, like crypto miners, to comply. And how it’ll probably drive entire areas of the crypto industry out of the USA:

Banishment or surveillance?

The Electronic Frontier Foundation, an advocate of people’s digital rights, makes the case that this provision in the bill expands the government’s surveillance, making it difficult to even write smart contracts, a central feature of Decentralised Finance/DeFi:

The bill could also create uncertainty about the ability to conduct cryptocurrency transactions directly with others, via open source code (e.g. smart contracts and decentralized exchanges), while remaining anonymous. The ability to transact directly with others anonymously is fundamental to civil liberties, as financial records provide an intimate window into a person’s life… This poor drafting appears to be yet another example of lawmakers failing to understand the underlying technology used by cryptocurrencies.

Then, nearly every thread on Twitter that reports these crypto provisions has commentators stating it is no accident that these provisions will cause crypto companies in the USA to move overseas, that the threat of crypto to the US dollar and to the existing financial services industry is large enough now that exile is preferable to coexistence.

Now.

There’s been sufficient discussion of this online that, as of this writing, there’s been pushback from at least three senators, who have proposed an amendment:

The update, filed by Sens. Ron Wyden, D-Ore.; Pat Toomey, R-Pa.; and Cynthia Lummis, R-Wyo. would specifically ensure the term “broker” excludes validators, hardware and software makers and protocol developers.

We don’t know yet whether this amendment will make its way into the final bill.

But it’s not enough. Here’s an example.

Decentralised exchanges – in or out?

Even with these exclusions, several parts of the crypto industry remain under threat, not least decentralised exchanges, or DEXes.

At a decentralised exchange, ‘you are your own brokerage account’, just like with a Bitcoin wallet, ‘you are your own bank’. There is no equivalent in the ‘real’ financial industry:

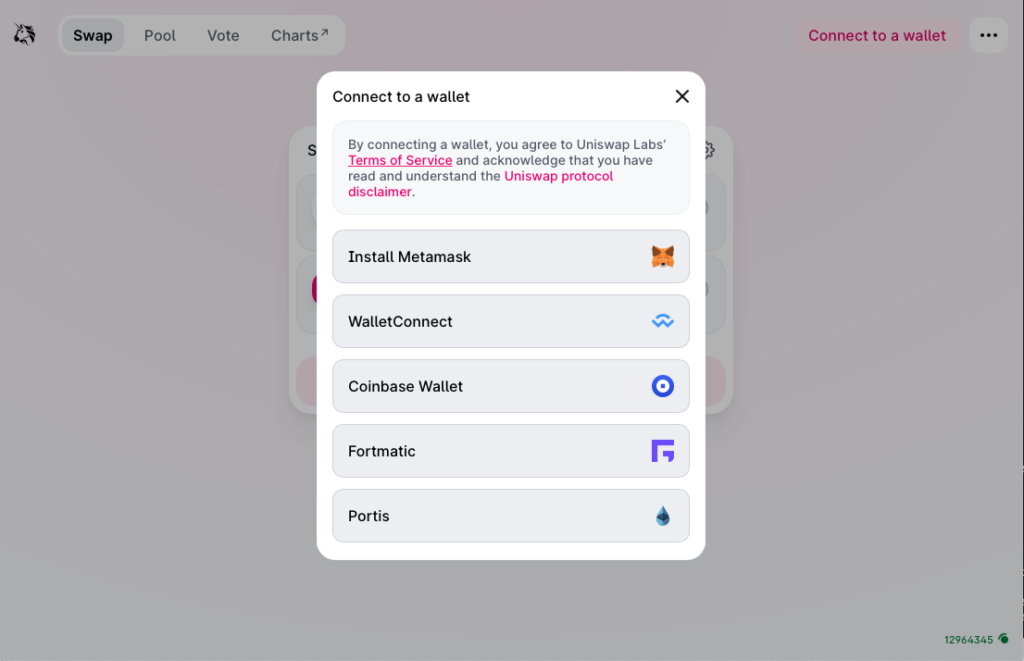

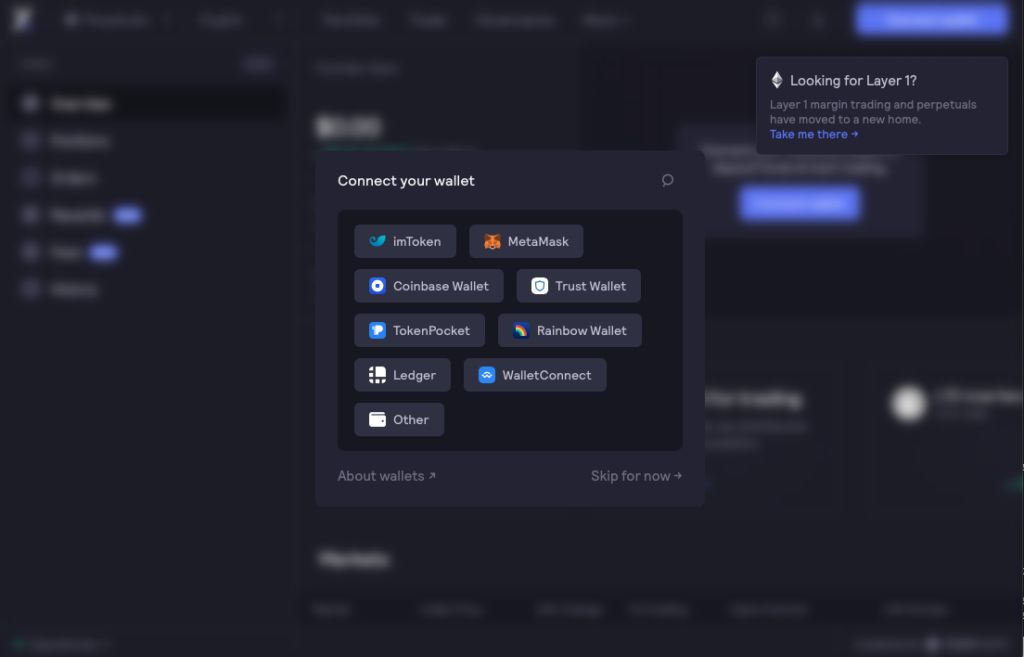

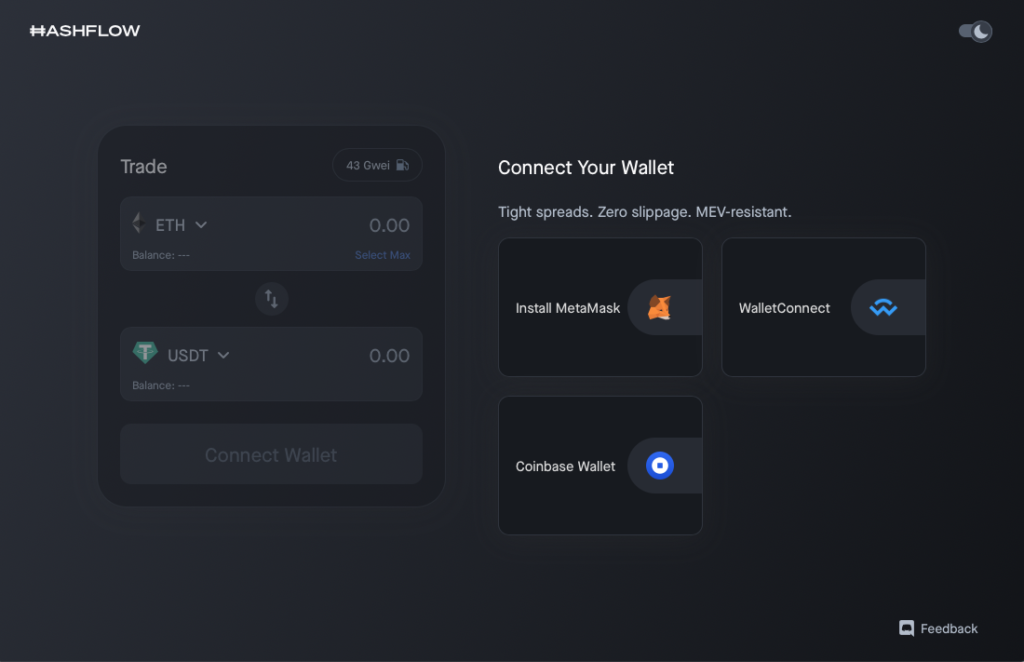

You don’t sign up and create an account at a DEX. The DEX doesn’t maintain a user registry and manage passwords. You connect an existing crypto wallet to the DEX to be able to buy and sell. When you buy, tokens are moved into your wallet from the wallet of someone else connected to the exchange. When you sell, they’re sent from your wallet to someone’s. See these screenshots for the DEXes Uniswap, dYdX and Hashflow:

You see there’s a ‘Connect Wallet’ button on each of these exchanges instead of ‘Sign up now’ or ‘Existing user? Login’ buttons. DEXes don’t need to bother with identity, and so they don’t. All the DEX does, at its core, is figure out demand and supply for a set of cryptocurrency pairs.

But this is incompatible with how the USA Congress views things. See this tweet from the senator who’s the Republicans’ chief interlocutor on the Infra bill:

This works for centralised crypto exchanges like Binance, Coinbase, Kraken, Gemini and several others, which are modelled on traditional stock exchanges, just that they trade crypto instead of stocks and ETFs. But it doesn’t translate to the decentralised exchanges we discussed, and even the senators who proposed an amendment to ostensibly bring some sanity to the crypto provisions in the bill – even those senators don’t get it.

To conclude: this is all rather ham-handed

Over all, the whole episode is a clumsy way to handle what part of the crypto industry should be subject to regulatory oversight, what activities should be taxed and how, and what should be disallowed.

Even the reason that the crypto provision is part of the bill is because infra investments need to be ‘revenue neutral’, that is, it needs to state clearly where the money to pay for infra is going to come from. To that end, the bill makes the assumption the crypto industry will contribute USD 28 billion in additional revenue through taxes, which will be used to fund national infrastructure projects.

The implication here of course is that there is a large amount of tax avoidance taking place – specifically, USD 28 billion over the next few years, and therefore greater oversight must be enforced.

Whether or not there’s tax avoidance in the crypto industry today, what that looks like, and how it needs to be plugged should really not be discussed in the context of a bill that deals with roads, bridges, ports and airports, EVs and the like – not least given that regulatory bodies and the USA government – the SEC, the Treasury Department and the Commodity Futures Trading Commission – are all working on their own regulations.

It’s unlikely that lawmakers will drop crypto altogether from the bill – it’s too far gone for anything other than small compromises. Like it or not, right or not, this is going to be the first major systemic regulation of the crypto industry in the USA.

(ends)