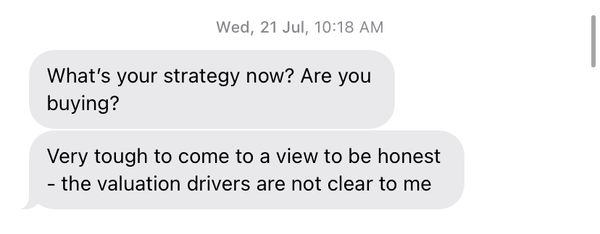

Back in July, Bitcoin had slumped to under half of its January highs of over $60,000. That dragged several other cryptocurrencies down with it, and the overall crypto market capitalisation fell several hundred billion dollars.Several friends and readers who held crypto messaged me asking whether they should get out and sell before the ‘market’ crashed further, or whether it was a good time and a good price to buy even more:

Like with any type of investing, if you aren’t clear about why you’re in it, the only thing you’re in for is anxiety. And that takes away from all the fun and fascination from the world of crypto.So I wrote a Twitter thread about it and shared it with all those friends. It’s helped a lot of them, so I’m posting it here with quick comments:

I’ve personally lost money in the June, September, November 2017 and the great December 2017 crash. The last one took nearly two years to recover from. But then it reached an all-time-high nearly three times its previous high. In that context, the recent July 2021 crash is nothing. Perspective is important.

of it. Or you’re sure that the financial system is ripe for collapse, or are just seeing really cool projects being built on blockchains. It doesn’t matter how short-term, cynical, opportunistic your interest. Or how deep and well thought out your personal convictions are. As long as you’re aware of them.Having said that:

As you read, if you can intuit and articulate your interest in the crypto space, you can craft a simple set of principles about when and what tokens to buy. I finished with this:

Not only is there a dizzying variety of tokens to evaluate, the value of many of those tokens now rivals Bitcoin and Ethereum. These latter two are far from the only influential projects in the crypto space any more. No matter what drives your interest in crypto, you have never had more choice to implement your investing plan than today.

Credits: