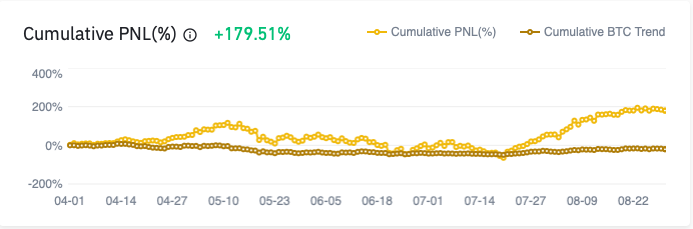

My holdings in Binance were up nearly 180% – or nearly 2.8x – in the five month period 1st Apr 2021 to 31st August 2021.

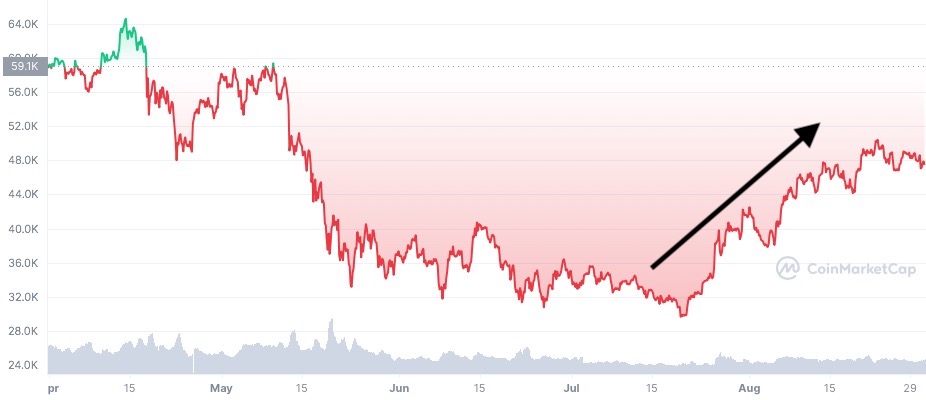

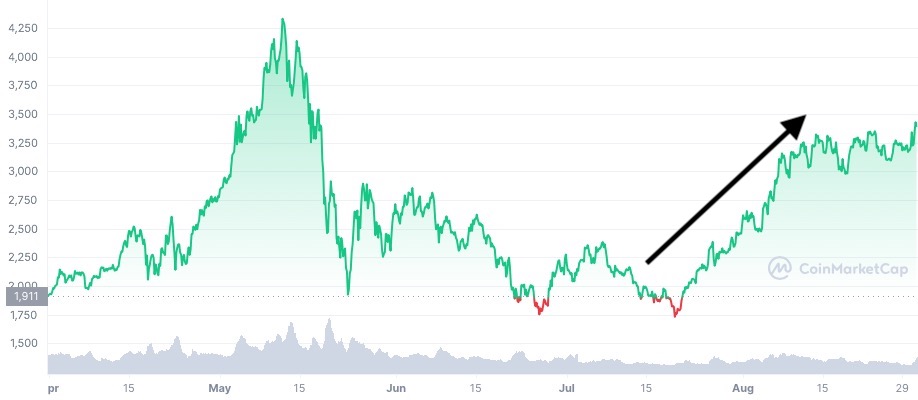

During this time, Bitcoin was down nearly 20%, from USD 59,000 to USD 47,300. Ethereum was up a little under 70%, from ~USD 1950 to ~USD 3300.

So the holdings did quite a lot better than either of these two coins by themselves.

Here is a quick peek into what I do.

Dollar-cost-averaging

In other words, making regular token purchases.

Bitcoin went down from USD 59,000 to nearly USD 29,000 before climbing to USD 47,000. Some of my holdings rode that rise.

Similarly, Ethereum rose to nearly USD 4,300, plummeting to almost USD 1,700 before rising back up to USD 3,300. Some of my holdings benefited from that last steep climb.

Diversification

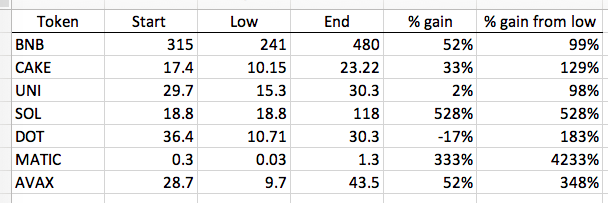

I hold a number of alt coins in addition to Bitcoin and Ethereum. These are all tokens whose projects I see merit in. Some of them are Binance Coin (BNB), Pancakeswap (CAKE), Uniswap (UNI), Solana (SOL), Polygon (MATIC), Avalance (AVAX).

I also added these in more than one tranche during this period. Here is how they have done over the five month stretch, and from their low during this time. As you can see, some of them have done rather well:

I also hold others in small proportions, whose rise and fall doesn’t affect the overall performance much. (and I hold some stablecoins whose value, by definition, doesn’t change).

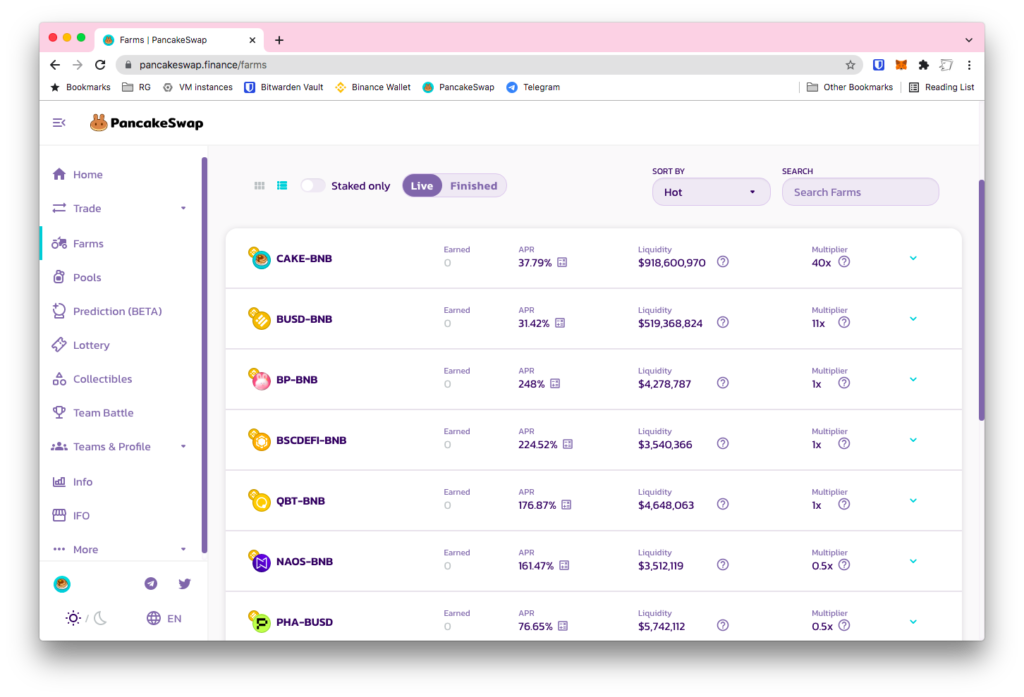

Yield farming and staking

Through staking and adding to liquidity pools. Explore the Earn section on the Binance exchange for these products. I also participate in these on the decentralised exchange Pancakeswap, which has a wider range of staking pools and liquidity pools than Binance itself. There are further layers of optimisation above this to take advantage of, which I may describe in a separate post.

Several of these offer attractive yields:

But – and I cannot emphasise this enough – there is risk proportional to that return. For instance in liquidity pools, you should at least be aware of the concept of impermanent loss.

I mitigate these risks with some pretty basic principles:

One, I only stake or add to pools with tokens that I am comfortable holding, whose use in the parent project I’m familiar with. I do not swap to acquire tokens only for the sake of attractive yields.

Two, I plan to hold these tokens for the long term. As of this writing, indefinitely (or until the project no longer shows promise). That protects me a great deal against impermanent loss, because I’m less likely to remove liquidity and realise those losses, if any.

So there you have it

- Dollar-cost-average into tokens, especially because they are so volatile

- Diversify your holdings, into projects that you understand and believe in

- Put those holdings to work through yield farming and staking, as long as you understand the risks involved.

Not all months, quarters or even years will be like this. Most of the crypto space is still largely speculative, so even dollar-cost averaging into good tokens that work hard for yields may result in nought as the market itself crashes. During those times it’s useful to be clear about why you want to hold crypto in the first place.

PS: what I describe is the active part of my holdings. I also hold Ethereum and Bitcoin in non-custodial wallets outside of Binance. Those are out-of-sight, out-of-mind holdings (“hodlings”). I keep the wallet passphrases secure but don’t check the value in those wallets very often.

Finally: consider subscribing to my once-a-week crypto newsletter for more like this.