In our last post, we looked at the hedge fund manager Ray Dalio’s opinions on cryptocurrency.

Recently, the hedge fund manager Stanley Druckenmiller was interviewed on a wide range of topics, which included cryptocurrency.

Druckenmiller, himself a billionaire, managed the legendary George Soros’ Quantum hedge fund for over a decade and then ran Duquesne, his own successful hedge fund, full-time. He is one of the major people profiled in the book More Money Than God by Sebastian Mallaby.

~ “So here’s something with a finite supply and 86% of the owners are religious zealots. I mean, who the hell holds something through $17,000 to $3000? And it turns out none of them — the 86% — sold it.” – on learning that people held bitcoin despite its massive volatility, which meant that there was something bigger in play.

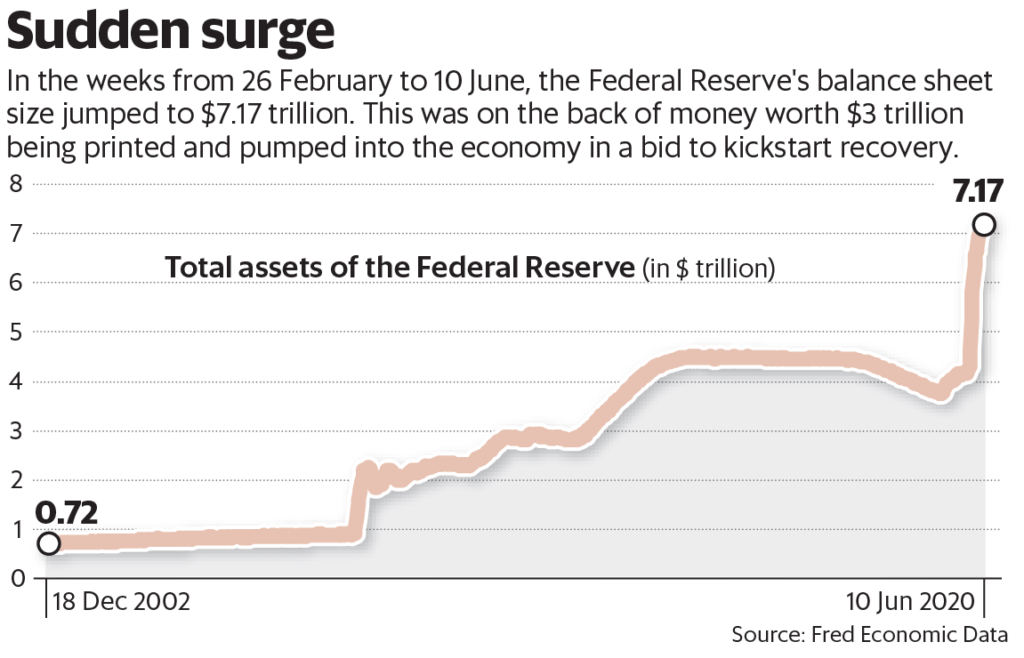

~ His opinion used to be that “crypto and Bitcoin are a solution in search of a problem” but now he realises, that it’s a credible hedge against the wearing of the US dollar. He has come around to the ‘digital gold’ view. See our last post for more detail on this.

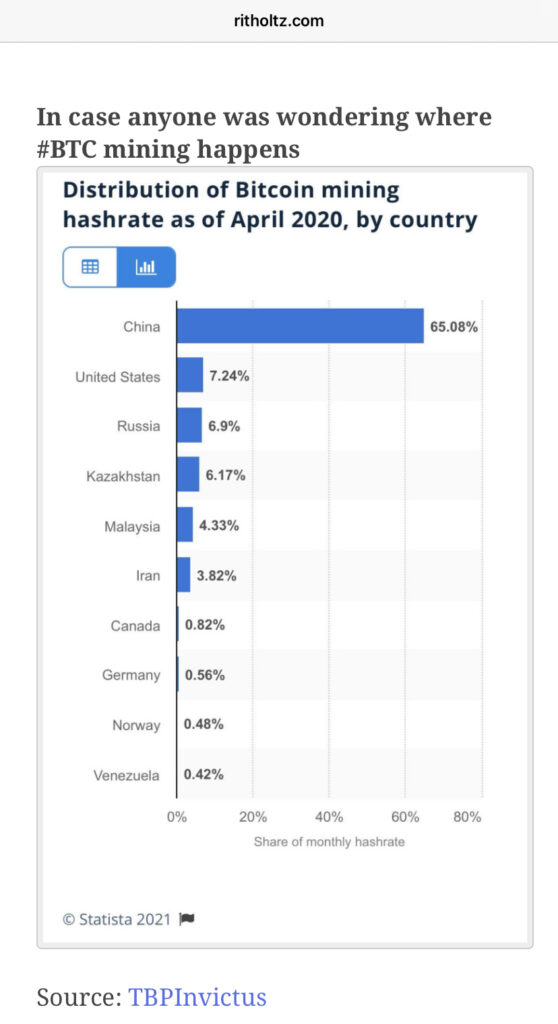

~ However, crypto markets are extremely shallow compared to other real assets: “I tried to buy $100m of Bitcoin at a price of $6,200. It took me 2 weeks to buy $20m. I bought it all around $6,500, I think… I can buy that much gold in 2 seconds… So like an idiot, I stopped buying it.”

~ Meanwhile, Ethereum is a leader in building decentralized applications today, but it could be like “Yahoo before Google came along. Google wasn’t that much faster than Yahoo, but it didn’t need to be. All it needed to be was a little bit faster and the rest is history”.

(Indeed, there do exist alternatives like Blockstack, Binance’s Smart Chain and Polkadot. But there are also sophisticated projects (Matic, Uniswap, Raiden and many others) to scale different aspects of Ethereum. We will explore these in upcoming posts).

~ Finally, follow the talent: “One of the ways we’ve always invested in the private sector is to try and figure out where the engineering kids from Stanford, Brown and MIT are going… So many of them are in love with crypto and that’s where they’re going.”