Earlier in February, the central bank of Nigeria banned its banks and financial institutions from servicing cryptocurrency exchanges. Nigerians now have little to no options to convert their local currency to bitcoin and cryptocurrency – which I suppose was the objective.

A few things in this context are notable:

~ This sounds identical to the 2018 ban by Reserve Bank of India.

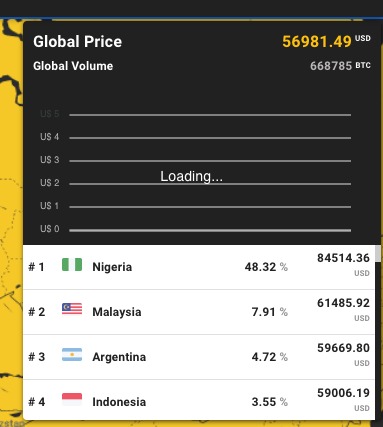

~ Bitcoin is now trading at nearly a 50% premium in Nigeria: see http://www.bitcoinpricemap.com

~ Since there are no online exchanges, this is probably on local P2P markets like https://localbitcoins.com . This is as transparent a signal as you can get for how desirable cryptocurrency is there. Bitcoin in Malaysia, Indonesia, India, Turkey, and most South American countries is also trading at significant premiums – although Nigeria is off the charts.

~ Late last year, there was press coverage internationally on how anti-police-brutality protestors were using bitcoin (and potentially other tokens) to raise funds:

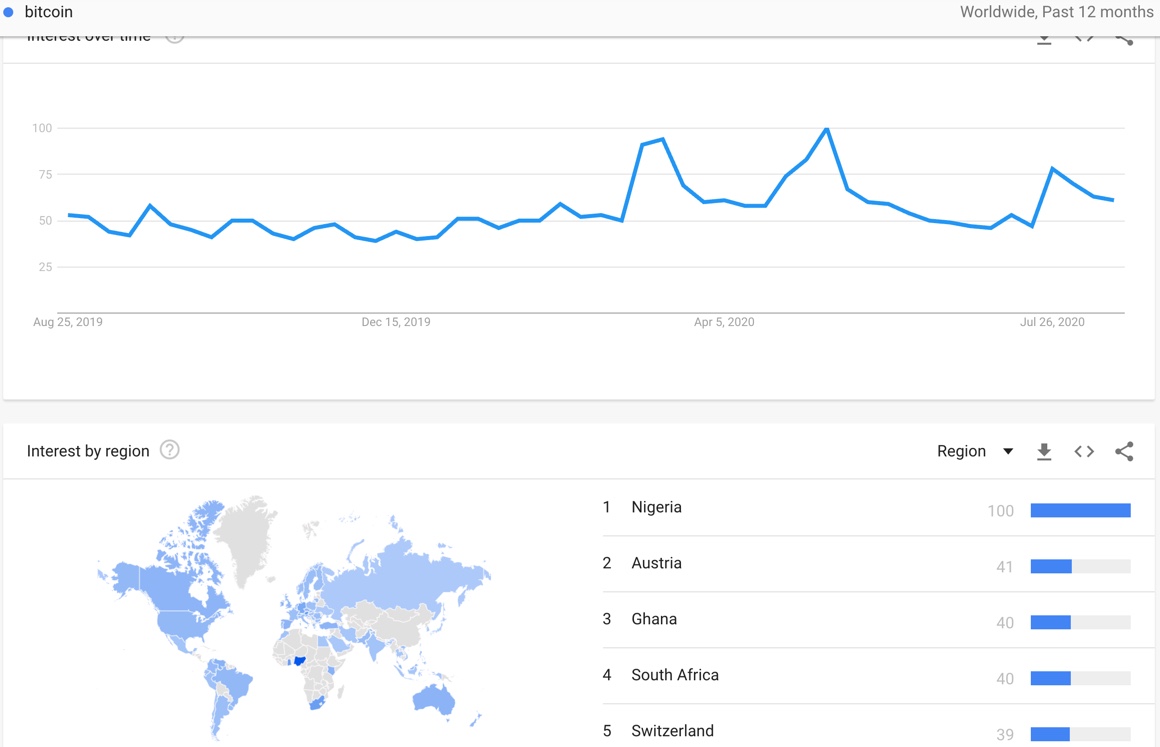

~ Throughout 2019 and 2020, Nigeria topped Google trends for searches around bitcoin. One reason could be simply because Nigeria’s currency really hasn’t done well versus the dollar, or simply because Nigeria is a very young country and there’s curiosity about crypto: